The Australian Dollar (AUD) has faced significant volatility in recent years, and many experts are now speculating whether it could plunge below 60 cents against the US dollar. With the global economic landscape undergoing profound shifts, the legacy of the Trump-era trade policies remains a critical factor in the current trajectory of the AUD. This article unpacks the interplay between global trade tensions, policy decisions, and the future of Australia’s currency, offering an in-depth analysis of the challenges that lie ahead.

The Trump Trade Legacy: An Overview

During Donald Trump’s presidency, the United States adopted an increasingly protectionist stance, a shift that had far-reaching consequences for the global economy. Trump’s “America First” agenda led to the imposition of tariffs on various countries, most notably China, and reshaped global trade dynamics. These policies not only strained relationships between major trading partners but also contributed to heightened economic uncertainty. For Australia, a nation that heavily relies on exports to sustain its economy, the effects of these trade policies have been both immediate and long-lasting.

The Trade War and Its Impact on Australia

One of the central elements of Trump’s trade strategy was his trade war with China, which had direct consequences for Australia. China is Australia’s largest trading partner, and the tariffs imposed on Chinese goods led to retaliatory measures that affected Australian exports. Agricultural products, in particular, faced significant disruptions, as China sought alternative suppliers in response to US tariffs. The volatility in global trade flows made it difficult for the Australian economy to maintain stability, contributing to fluctuations in the value of the AUD.

However, the economic fallout of the trade war extended beyond just exports. The global uncertainty surrounding the trade conflict contributed to a flight to safety among investors, with many turning to the US dollar as a safe haven. This shift in investor behavior put downward pressure on the AUD, pushing it lower against the US dollar. The effects were compounded by rising commodity prices, particularly iron ore, which is a key export for Australia. Despite the overall strength of the Australian economy during this period, the currency’s performance remained vulnerable to global economic tensions.

Global Economic Uncertainty and the Australian Dollar

The rise in global economic uncertainty is another significant factor influencing the future of the AUD. The global economy remains fragile, with numerous challenges ranging from geopolitical tensions to the lingering impacts of the COVID-19 pandemic. The Federal Reserve’s aggressive monetary tightening, designed to combat inflation in the US, has further exacerbated the situation. As interest rates rise in the United States, capital flows have shifted in favor of the US dollar, leaving the AUD to face pressure on global markets.

Australia, while benefiting from strong economic fundamentals, is not immune to these macroeconomic forces. The Reserve Bank of Australia (RBA) has been attempting to manage inflation while navigating these external headwinds, yet the domestic economy’s reliance on global trade means the Australian dollar remains highly sensitive to international developments. As interest rate differentials widen between the US and Australia, the AUD could come under further pressure in the coming months.

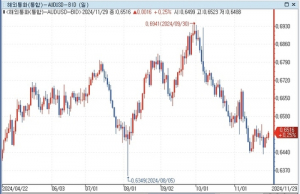

The Potential for the Australian Dollar to Drop Below 60 Cents

Given the current economic environment, many financial analysts are speculating whether the AUD will fall below the psychologically important 60-cent mark against the US dollar. This level is seen as a threshold that could trigger more significant concerns for both the Australian economy and global investors. However, there are several factors that could influence whether this scenario becomes reality.

Commodity Prices and the Australian Dollar

A key factor that has historically supported the value of the Australian dollar is the country’s vast natural resource base. Australia is one of the world’s largest exporters of commodities such as coal, iron ore, and liquefied natural gas (LNG). As global demand for these commodities fluctuates, so too does the value of the AUD. The Australian dollar is often referred to as a “commodity currency,” meaning its value tends to rise when commodity prices are strong and fall when they weaken.

Currently, commodity prices have been relatively robust, driven in part by supply constraints and strong demand from countries like China. If these trends continue, they could provide some support for the Australian dollar. However, the global economic slowdown, particularly in key markets like China, could limit the potential for significant price increases. Additionally, as the world transitions to greener energy sources, there is the potential for long-term structural changes in the demand for some of Australia’s key exports, which could weigh on the AUD.

The Role of Interest Rates and Monetary Policy

Interest rates play a significant role in currency valuation, and Australia’s monetary policy is central to determining the future direction of the AUD. As the US Federal Reserve has raised interest rates in an effort to curb inflation, the interest rate differential between the US and Australia has widened, contributing to capital inflows into the US dollar. If the RBA maintains a more dovish stance or is slower to raise rates compared to the Federal Reserve, the Australian dollar could continue to face downward pressure.

However, the RBA has indicated that it is committed to keeping inflation under control, and further interest rate hikes cannot be ruled out. If Australia’s central bank acts aggressively in response to inflationary pressures, it could help stabilize the AUD. Still, this would depend on broader economic conditions and how investors perceive the stability of the Australian economy in comparison to other markets.

Geopolitical Risks and Global Trade Dynamics

Beyond economic factors, geopolitical risks also play a significant role in the trajectory of the Australian dollar. The ongoing tensions between the US and China, as well as other global trade disputes, could continue to create volatility in global markets. For Australia, which is deeply integrated into the global trading system, any disruption to trade flows could have a profound effect on the AUD.

Australia’s relationship with China is particularly crucial, as the nation is Australia’s largest trading partner. Should relations between these two nations deteriorate further, it could lead to further disruptions in Australian exports and exacerbate the downward pressure on the Australian dollar. Similarly, ongoing tensions in the Indo-Pacific region could increase risks for the Australian economy and its currency.

Broader Implications for Australia’s Economy

The potential decline of the Australian dollar below the 60-cent threshold could have significant economic consequences. A weaker AUD would make imports more expensive, contributing to inflationary pressures that could hurt Australian consumers and businesses. On the other hand, a lower currency value could boost export competitiveness, potentially benefiting Australian industries that rely on global markets.

In addition, a sharp depreciation of the AUD could affect investor confidence in the Australian economy. If investors begin to view the Australian dollar as increasingly risky, it could lead to capital outflows and further pressure on the currency. This could pose a challenge for the Australian government and the RBA as they work to balance economic growth with inflation management.

What’s Next for the Australian Dollar?

The outlook for the Australian dollar remains uncertain, and several factors will play a crucial role in determining its future direction. While global economic tensions and the Trump-era trade policies continue to have lingering effects, Australia’s commodity exports, interest rate policy, and geopolitical positioning will all influence the currency’s performance.

For investors and policymakers, the key question is whether the global economy will stabilize or continue to experience volatility in the coming years. As long as geopolitical risks and economic uncertainty persist, the Australian dollar is likely to remain vulnerable to fluctuations. For now, it seems that a drop below 60 cents is not entirely out of the question, but a range of factors will determine whether this occurs and how long it lasts.

Conclusion

The Australian dollar’s future value will be shaped by a complex interplay of global economic forces, trade policies, and domestic monetary decisions. While the legacy of Donald Trump’s trade policies still casts a long shadow over the global economy, Australia’s currency is also influenced by commodity prices, interest rate differentials, and geopolitical risks. While a plunge below 60 cents remains a possibility, the actual trajectory of the AUD will depend on how these various factors evolve in the coming months and years.

As Australia navigates these turbulent waters, both policymakers and investors will need to closely monitor global developments and be prepared to adapt to the shifting economic landscape. The Reserve Bank of Australia and other economic stakeholders will play a crucial role in guiding the country through these uncertain times, ensuring that the Australian dollar remains a resilient asset in the face of ongoing challenges.

See more CCTV News Daily