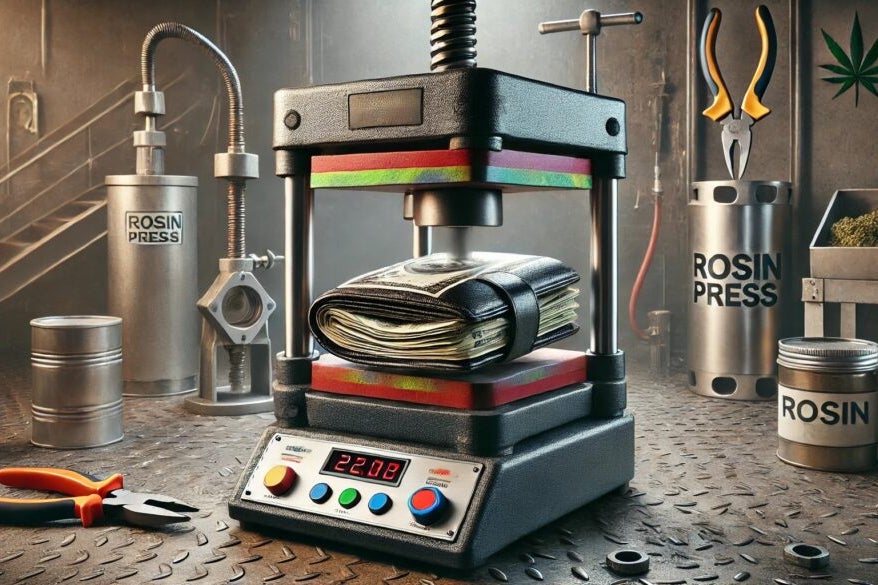

As the cannabis industry continues to grow in the United States and other regions where marijuana has been legalized, one aspect of the market is becoming increasingly clear: taxes on marijuana are driving up prices for consumers. While marijuana taxes were originally seen as a means to fund public initiatives, they also have unintended consequences, especially for consumers. As marijuana becomes more widely accepted for both medicinal and recreational use, understanding the financial impact of marijuana taxes is crucial for both buyers and policymakers. This article explores how marijuana taxes influence your wallet, why they are so high, and what it means for the future of legal cannabis markets.

Understanding Marijuana Taxes: A Complex Web of Rates

When marijuana was first legalized for recreational use in states like Colorado and Washington, it was celebrated as a milestone in the cannabis movement. However, what many consumers did not anticipate was the high cost of legal marijuana, much of which is attributed to taxes. Unlike many other products, marijuana is taxed in several different ways, each contributing to the final price paid by the consumer.

- Excise Taxes: These are taxes applied directly to marijuana sales. States impose excise taxes on both medical and recreational marijuana, but the rates can differ. For instance, California imposes a 15% excise tax on retail sales, while Oregon has a more modest 17% rate.

- Sales Tax: In addition to excise taxes, some states apply regular sales taxes to marijuana purchases. Sales tax rates for cannabis are often higher than those for other consumer goods, with some states imposing rates exceeding 10%.

- Local Taxes: Many cities or counties where marijuana is legal also impose their own taxes. These local taxes can be particularly burdensome, sometimes adding an additional 5-10% to the cost of cannabis.

- License and Regulatory Fees: In addition to the direct taxes on the sale of marijuana, cannabis businesses are often required to pay various licensing and regulatory fees. These costs are typically passed down to consumers in the form of higher prices.

The Price Impact: How Much Are Taxes Really Adding?

The effect of taxes on marijuana prices is not just a matter of a few extra dollars at checkout. In some states, taxes can add as much as 40% to the price of cannabis, significantly raising the cost for consumers. A study conducted by the Society for Human Resource Management found that in 2022, consumers in California paid, on average, 35-40% more for their marijuana products due to excise, sales, and local taxes.

To put this into perspective, if a consumer were to purchase a gram of marijuana in California at $10 before taxes, they could end up paying as much as $14 after taxes, depending on the locality and product type. The situation becomes even more pronounced for larger quantities of marijuana, where the tax burden can result in significant cost differences across states.

Why Are Marijuana Taxes So High?

The reasons behind these high marijuana taxes are multifaceted, rooted in both the legal history of cannabis and the need for states to generate revenue from the new legal market.

- Revenue Generation: Legal marijuana is seen as a new source of revenue for states, which can use the funds to support education, infrastructure, and public health initiatives. For example, Colorado has generated over $1.5 billion in cannabis tax revenue since legalization, with a large portion going towards schools and public health programs.

- Regulatory Costs: Cannabis businesses are subject to a complex web of state and local regulations that require costly enforcement mechanisms. The fees associated with maintaining compliance—such as regular inspections, security requirements, and employee training—are passed onto consumers.

- Discouraging Consumption: Some policymakers argue that high taxes are a way to limit the use of marijuana by making it less accessible. This approach follows the logic behind heavy taxation of products like tobacco and alcohol, which have long been used as public health tools to curb consumption.

Unintended Consequences: The Black Market Persists

One of the most significant challenges of high marijuana taxes is the persistence of the black market. Even in states with legal cannabis, consumers often find the prices of legal marijuana to be prohibitively high, especially for lower-income individuals or those who require marijuana for medicinal purposes. As a result, the black market continues to thrive in many areas, offering marijuana at significantly lower prices than its legal counterparts.

This presents a paradox for policymakers: while taxes on marijuana are designed to curb illegal activity and generate revenue, high taxes may inadvertently drive consumers back to the illicit market. For instance, in California, a report from the California Cannabis Industry Association found that illegal cannabis sales accounted for over 60% of the market share in 2022, despite the state’s highly developed legal cannabis infrastructure.

Impact on Consumer Behavior: What Do High Taxes Mean for Buyers?

For the average consumer, high marijuana taxes are likely to influence both purchasing habits and overall spending. The price sensitivity of cannabis buyers is higher than that of many other consumer goods, meaning that even a slight price increase can result in significant changes in consumer behavior.

- Price Sensitivity: Consumers may opt to buy less marijuana, seek out lower-potency products, or even return to the black market if the price difference is significant enough. For medicinal marijuana users, this could mean choosing lower-quality or less effective products due to cost concerns.

- Shifts in Consumption Patterns: High taxes might lead to a reduction in regular cannabis consumption or a shift toward more affordable consumption methods. For example, consumers may switch from purchasing pre-rolls or concentrates to buying flower, which is generally cheaper.

- Disincentivizing Legal Markets: As marijuana taxes increase, consumers may feel disillusioned with the legal market, which could undermine efforts to phase out the illegal market. This might also reduce overall tax revenue in the long run, creating a cycle where high taxes make the legal market less competitive.

What Does the Future Hold for Marijuana Taxes?

The future of marijuana taxes is uncertain, as states, municipalities, and cannabis businesses continue to grapple with how to balance revenue generation with the goal of creating a fair and accessible legal market. Some states may consider reducing tax rates or eliminating some types of taxes to better compete with the black market, while others may focus on improving regulatory efficiency to lower costs for consumers. In recent years, there has been a movement in several states to reduce cannabis taxes or implement tax breaks, particularly for medical marijuana patients.

Moreover, as federal legalization of marijuana becomes a more realistic possibility, the landscape of cannabis taxes could shift dramatically. Federal legalization would allow for uniform tax policies across states and potentially lower the overall tax burden on consumers. However, it could also lead to new federal taxes, adding yet another layer of complexity to the cannabis tax structure.

Marijuana taxes are a critical factor that shapes the cost of legal cannabis. While these taxes generate much-needed revenue for states and fund public health initiatives, they also come with unintended consequences, such as higher prices for consumers and the persistence of the black market. As the cannabis market continues to evolve, it will be essential for lawmakers to strike a balance between ensuring fair tax rates and maintaining the accessibility and competitiveness of the legal market.

For consumers, it’s important to stay informed about the tax policies in their state and consider how they impact both their wallets and the larger cannabis industry. While high taxes may seem burdensome, they also play a pivotal role in the growth of the legal marijuana market and in shaping the future of cannabis regulation.

To learn more about the impact of marijuana laws and taxes, visit CNBC’s cannabis section.

See more CCTV News Daily