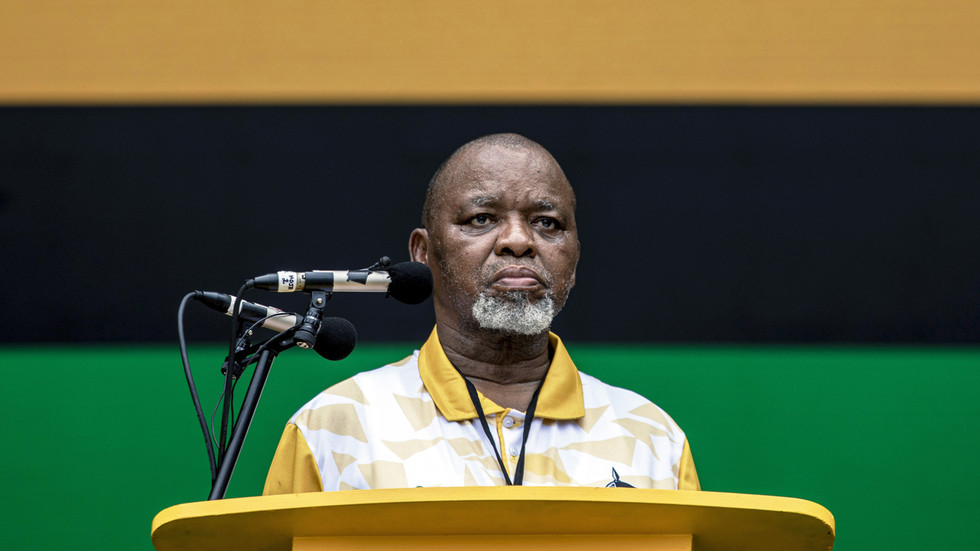

South Africa’s Bold Move: Minister Proposes Export Ban on Minerals to the US

In a surprising turn of events, a South African minister has called for a suspension of mineral exports to the United States, raising questions about international trade dynamics and resource management. This decision has the potential to reshape not only the bilateral relationship between South Africa and the US but also to impact global markets reliant on these vital resources. The proposal, which has sparked intense debate among economists, industry leaders, and policymakers, underscores the growing complexity of global trade, especially regarding natural resources.

The Context Behind the Proposal

South Africa is rich in mineral resources, including platinum, diamonds, gold, and various rare earth elements. The country has long been a major supplier of these minerals to the United States, which relies on them for various industries, from electronics to automotive manufacturing. The minister’s proposal comes against a backdrop of increasing scrutiny over how these resources are exploited and managed.

Several factors have contributed to this bold move:

- Resource Nationalism: There is a growing sentiment in South Africa to prioritize local industries and communities over foreign interests. This push for resource nationalism aims to ensure that the wealth generated from mineral exports benefits South African citizens directly.

- Environmental Concerns: Mining and mineral extraction have significant environmental impacts. The South African government is under pressure to balance economic growth with sustainable practices, leading to calls for stricter regulations on exports.

- Geopolitical Tensions: The global political landscape is shifting, with countries reassessing their trade relationships. South Africa’s move can be seen as a strategic attempt to assert its position on the world stage.

Potential Implications for South Africa

The proposed export ban on minerals to the US could have several implications for South Africa:

Economic Impact

South Africa’s economy is heavily reliant on mineral exports. A sudden halt could lead to:

- Immediate Financial Strain: Many South African companies depend on the US market for their mineral exports. An abrupt ban could result in significant revenue losses, job cuts, and a slowdown in economic growth.

- Shift in Trade Relationships: South Africa might need to explore new markets for its minerals, potentially leading to a recalibration of its trade partnerships.

Political Ramifications

This move could also have political ramifications:

- Domestic Support: The proposal may gain support from local communities and labor unions who feel that the current export practices do not benefit them adequately.

- International Relations: South Africa’s relationship with the US might be strained, leading to potential diplomatic repercussions.

Implications for the United States

For the United States, South Africa’s proposed export ban could also lead to significant challenges:

Supply Chain Disruptions

Many industries in the US rely on South African minerals:

- Automotive and Electronics: The automotive industry, in particular, is heavily dependent on platinum for catalytic converters. A ban could disrupt production and increase costs.

- Increased Prices: A sudden shortage of minerals could lead to price hikes, affecting consumers and businesses alike.

Strategic Reassessment

The US may need to rethink its supply chain strategies, which could include:

- Diversifying Sources: The US might look to other countries for mineral imports, which could lead to geopolitical shifts.

- Investing in Domestic Production: There may be renewed interest in developing domestic mining operations to reduce reliance on foreign minerals.

Global Market Reactions

The proposed export ban is already causing ripples in global markets:

Market Volatility

Commodity markets are sensitive to changes in supply and demand dynamics. Analysts predict:

- Price Fluctuations: Anticipated shortages could lead to increased volatility in mineral prices, affecting global markets.

- Investor Sentiment: Investors may react cautiously, leading to short-term disruptions in stock prices for companies reliant on South African minerals.

Shifts in Trade Dynamics

Other countries may also seize the opportunity to fill the potential gap left by South African minerals:

- Emerging Markets: Nations with rich mineral deposits may look to increase their exports to the US, reshaping global trade patterns.

- Increased Competition: This shift could intensify competition among mineral-rich countries, impacting pricing and availability.

Looking Ahead: A Balancing Act

As South Africa navigates this complex situation, the government will need to strike a delicate balance:

- Economic Growth vs. Sustainability: Ensuring that mineral resources are utilized in a way that promotes sustainable development while still providing economic opportunities is crucial.

- Domestic Needs vs. International Obligations: The government must also consider the needs of its citizens while maintaining positive relationships with international partners.

Conclusion

South Africa’s bold move to propose an export ban on minerals to the US is a significant decision that could reshape not only its economy but also international trade dynamics. While the proposal reflects a growing trend toward resource nationalism and sustainability, it also poses risks and challenges that need careful consideration. The coming months will be critical as stakeholders from both nations assess the implications and navigate the complexities of this evolving landscape.

In a world where resources are increasingly contested, South Africa’s decision serves as a reminder of the intricate balance between local priorities and global responsibilities. As the situation unfolds, it will be essential for all parties involved to engage in constructive dialogue to ensure a mutually beneficial outcome.

See more CCTV News Daily