As global trade continues to evolve, one of the most potent weapons in international diplomacy has become the U.S. dollar. With its status as the dominant global reserve currency, the dollar plays an essential role in shaping economic interactions across borders. However, as President Donald Trump escalates trade threats against a range of nations, particularly those hesitant to rely on the dollar, the geopolitical landscape is witnessing seismic shifts. This article delves into the broader implications of these trade threats, the strategic role of the U.S. dollar, and the potential fallout for international markets.

The U.S. Dollar’s Dominance in Global Trade

The U.S. dollar has long been the world’s primary reserve currency, widely used in international transactions, investments, and trade settlements. This dominance is a result of historical factors, including the Bretton Woods system established in the aftermath of World War II, which pegged global currencies to the dollar. The strength of the U.S. economy, coupled with the stability and liquidity of U.S. financial markets, solidified the dollar’s position as the currency of choice for global trade.

In recent years, however, tensions have emerged as certain nations—particularly those engaged in complex trade relationships with the U.S.—begin to explore alternatives to the dollar. Russia, China, and several countries in the Middle East have voiced increasing interest in diversifying away from the dollar, aiming to reduce their dependence on the U.S. financial system. The rise of digital currencies and the formation of trade blocs that bypass the dollar, such as the Chinese-led Belt and Road Initiative, further complicate the dollar’s hegemonic status.

Trump’s Trade Threats and Their Economic Repercussions

Under President Trump’s leadership, the U.S. has employed aggressive trade tactics, including tariffs, sanctions, and threats of economic isolation, to force nations into compliance with U.S. policy priorities. These trade threats are particularly significant for countries that rely heavily on the U.S. market for exports or those that conduct a substantial portion of their trade in dollars.

For instance, Trump’s tariff wars with China have had a far-reaching effect, not only on the two nations involved but also on the broader global economy. China, as the world’s second-largest economy, has become a key player in international trade and finance. By leveraging its economic clout, China has increasingly sought to promote the use of the yuan in global trade, particularly with its Belt and Road Initiative (BRI). In response to U.S. tariffs and the trade war, China has been gradually shifting to non-dollar transactions with partner countries.

While the idea of “decoupling” from the U.S. dollar remains a long-term goal, it has gained significant traction among nations seeking more economic sovereignty and reduced exposure to U.S. sanctions. This includes countries such as Iran, Venezuela, and Russia, all of which have faced severe U.S. sanctions that restrict their access to global financial markets.

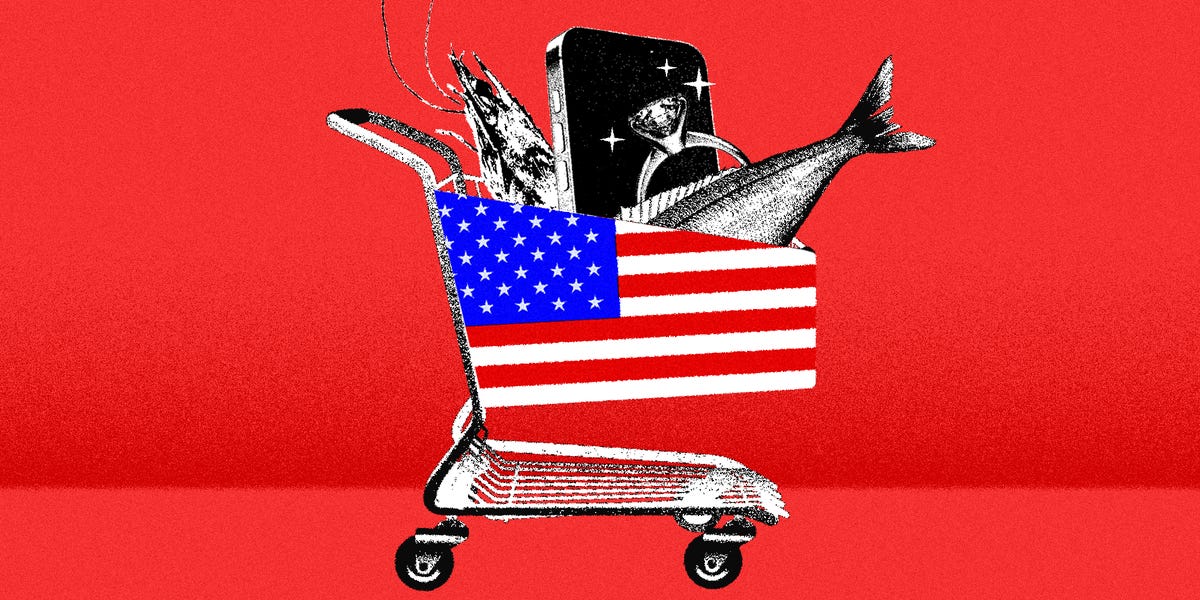

The Key Goods and Markets Affected

The U.S. is a major trading partner for several countries whose economies are deeply interconnected with global markets. Trump’s trade policies have the potential to disrupt the flow of key goods imported from these nations, with reverberating effects for international trade.

- China: The U.S. imports a wide range of products from China, including electronics, machinery, and consumer goods. As tariffs increase, the cost of these imports rises, affecting U.S. consumers and businesses alike.

- Mexico: A significant portion of U.S. imports from Mexico includes automobiles, machinery, and agricultural products. Trump’s threats to impose tariffs or close the border could severely disrupt these trade flows.

- Germany: The U.S. imports high-value industrial products from Germany, including automobiles and pharmaceuticals. German manufacturers could face difficulties if trade relations deteriorate further.

- Japan: Japan’s export of technology and automotive products is critical to the U.S. economy. Trump’s trade policies risk increasing the cost of these goods and decreasing the global competitiveness of U.S. businesses.

- Saudi Arabia: The U.S. imports significant quantities of oil from Saudi Arabia. Any potential disruption to this trade could have ripple effects on global oil prices, affecting energy markets worldwide.

The challenge for many of these nations is to navigate their dependence on the U.S. dollar for trade while seeking alternatives to mitigate the risk of future trade conflicts. The most immediate impact of these trade threats is a rise in transaction costs, as companies and governments may need to seek new trading partners or adopt costly measures like currency hedging to protect against dollar volatility.

The Dollar’s Vulnerability: Can It Be Replaced?

Despite the dollar’s continued dominance, questions about its long-term viability as the world’s primary reserve currency are gaining momentum. Some argue that the U.S. is inadvertently accelerating the process of de-dollarization by weaponizing the currency in its trade wars and sanctions policies. The creation of alternative payment systems, such as China’s Cross-Border Interbank Payment System (CIPS) or Russia’s SPFS, signals a growing move away from reliance on the U.S. dollar in global trade settlements.

However, replacing the dollar as the dominant global currency would be a monumental task. The dollar benefits from a well-established network effect—its widespread use creates a self-reinforcing demand. Furthermore, the size and liquidity of U.S. financial markets provide a level of stability and security that few currencies can match. The yuan, despite China’s best efforts, remains a relatively small player in global trade, largely due to concerns over the transparency and reliability of China’s financial system. Likewise, the euro, while a strong contender, lacks the deep and liquid financial markets that characterize the U.S. economy.

Thus, while the dollar faces challenges, the likelihood of its immediate replacement seems remote. That said, a gradual shift toward a multipolar currency system, where the U.S. dollar shares dominance with other regional currencies like the euro or yuan, is increasingly plausible.

The Geopolitical Implications of Dollar Devaluation

The growing interest in de-dollarization has profound geopolitical consequences. If countries successfully reduce their reliance on the U.S. dollar, it could undermine the U.S.’s ability to exert economic influence over the global stage. For example, U.S. sanctions against Iran and Venezuela, both of which have sought to bypass the dollar, may have less bite if other nations adopt alternative currencies for trade.

The U.S. also risks weakening its role as the global financial center. If major economies and institutions begin to favor other currencies or financial systems, this could erode the demand for U.S. Treasury bonds, which have historically served as a safe haven in times of economic uncertainty. This, in turn, could lead to higher borrowing costs for the U.S. government and a loss of its economic leverage.

Broader Economic Consequences

The fallout from Trump’s trade threats and the ongoing discussions about de-dollarization could have broader implications for the global economy. A shift away from the U.S. dollar may lead to greater currency volatility, as nations and businesses adjust to new trade norms. Additionally, financial markets could face increased uncertainty, as investors may need to diversify their portfolios to account for rising risks in non-dollar denominated assets.

On the other hand, some experts argue that these changes could lead to a more balanced global financial system, one less dependent on the U.S. and more representative of the multipolar world in which we now live. In this scenario, countries may find greater economic sovereignty and reduced exposure to U.S. policy shifts, though such a transition could take years or even decades.

Conclusion: The Future of the Dollar and Global Trade

The escalating trade threats under President Trump are accelerating the conversation about the future of the U.S. dollar in global trade. While the dollar’s dominance remains unchallenged for now, growing calls for diversification and de-dollarization are forcing a reevaluation of its role in the global economy. Countries are increasingly looking for ways to reduce their exposure to U.S. economic power, while the U.S. continues to use the dollar as a tool of diplomacy and leverage.

In the coming years, the global economy could witness a significant shift in trade dynamics, with implications for currencies, financial markets, and geopolitics. The potential fallout from this transition will require careful navigation by businesses, governments, and financial institutions alike. Whether this trend toward de-dollarization will ultimately succeed or falter remains to be seen, but its implications for global economic stability cannot be ignored.

For more information on U.S. trade policy and its impact on the global economy, visit Reuters for the latest developments.

See more CCTV News Daily