Trump’s Bold Move: Tripling Tariffs on Low-Value Imports from Asia

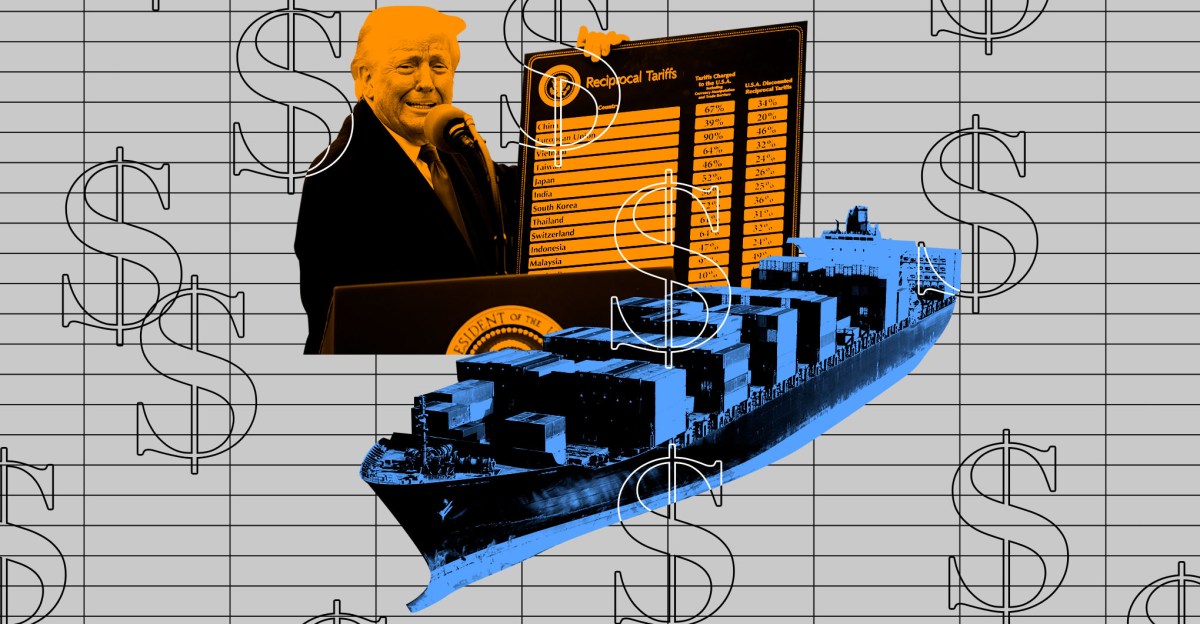

In a dramatic policy shift, former President Donald Trump announced plans to triple tariffs on low-value imports from China and Hong Kong, targeting packages valued under $800. The surprise decision, revealed on Tuesday, aims to curb what Trump calls “unfair trade practices,” but critics warn it could disrupt e-commerce, raise consumer prices, and escalate trade tensions.

The Tariff Hike: Scope and Immediate Impact

The new policy increases duties from the current 7-15% range to as high as 45% for goods shipped under Section 321, a provision allowing duty-free entry for packages under $800. Analysts estimate this could affect over 600 million annual shipments, including:

- Electronics accessories (e.g., phone cases, cables)

- Apparel and footwear

- Home goods and toys

“This isn’t just a tariff—it’s a seismic shift for small businesses relying on affordable imports,” said trade economist Dr. Linda Chen of the Peterson Institute. “A $10 item now costing $14.50 may force retailers to absorb losses or pass costs to consumers.”

Rationale Behind the Decision

Trump framed the move as retaliation against China’s “exploitation of de minimis loopholes,” claiming foreign sellers evade billions in duties. Data from U.S. Customs shows Section 321 imports surged from 220 million packages in 2016 to 685 million in 2023, with 60% originating from China.

“We’re leveling the playing field for American manufacturers,” Trump stated at a press conference. However, critics argue the policy could backfire. “Tariffs are taxes on consumers,” countered National Retail Federation CEO Matthew Shay. “This disproportionately hits middle-class families buying budget-friendly goods.”

E-Commerce Platforms and Sellers Brace for Disruption

Marketplaces like Amazon, eBay, and Temu face logistical headaches. Many third-party sellers use “direct-to-consumer” shipping from Chinese warehouses to bypass traditional import fees. A Temu spokesperson warned, “Abrupt cost increases may force price hikes or reduced product variety.”

Meanwhile, U.S. fulfillment centers report surging inquiries from sellers seeking domestic storage. “Warehouse leases jumped 30% in 24 hours,” noted logistics firm Flexe’s CEO Karl Siebrecht. “But relocating inventory takes months—this creates a perfect storm.”

Global Trade Implications and Potential Retaliation

The move risks reigniting U.S.-China trade wars. Beijing’s Commerce Ministry called the tariffs “protectionist” and hinted at countermeasures, possibly targeting U.S. agricultural exports. In 2023, China purchased $35 billion in U.S. farm goods, making retaliation a potent threat.

However, some experts see strategic timing. “With China’s economy slowing, they may tolerate higher tariffs to maintain export volumes,” suggested former U.S. Trade Representative Robert Lighthizer.

What’s Next for Businesses and Consumers?

Stakeholders are scrambling to adapt:

- Retailers: Big-box stores may shift sourcing to Vietnam or India, but experts note this requires 12-18 months.

- Consumers: Expect 5-15% price increases on affected goods by Q4 2024.

- Policy: Legal challenges are likely, citing potential violations of the 2016 Trade Facilitation Act.

As the dust settles, one thing is clear: the era of ultra-cheap, duty-free e-commerce may be ending. Businesses must weigh supply chain overhauls against shrinking margins, while policymakers debate whether protectionism fosters resilience or invites inflation.

For ongoing updates on trade policy impacts, subscribe to our industry newsletter or follow our live coverage of the 2024 election’s economic agenda.

See more CCTV News Daily